Notional Finance delivers verifiable DeFi yield at fastened charges for 1 yr. Lend & Borrow right now!

Dear Bankless Nation,

Bear markets generally is a bummer.

Unless you’re a crypto mega whale hoovering up capitulation plankton, chances are high quantity go down for some time.

And even in case you’re a grizzled crypto vet who’s seen all of it earlier than, difficult occasions are in retailer.

If it’s your first cycle, you’re gonna be taught rather a lot about your self throughout this era.

We’re right here to assist ensure that they’re good issues.

Bankless Editor Jem Khawaja is a bonafide bear market stoic.

He claims to have by no means bought a single ETH. 😱

Here are some issues he discovered the onerous means…

— Bankless

🙏 Sponsor: Polygon Studios—Fostering tradition throughout Gaming, NFTs, and the Metaverse✨

Last week, one among Ethereum’s largest L2-integrated dapps — derivatives big dYdX — introduced plans to depart Ethereum upon its upcoming v4 launch. Chaos ensued.

The vacation spot? A completely sovereign blockchain on the Cosmos. We introduced on dYdX Founder Antonio Juliano to debate the announcement on our newest livestream.

Watch it.

THOUGHT THURSDAY // Bankless Editor, Jem Khawaja

If you fancy your self one thing of a quant, savant, or dealer with intentions of enjoying the market, take a look at How to Survive a Crypto Bear Market.

This article is for individuals who intend to HODL out the crypto winter.

No quantity of worrying, stressing, panicking, moping, or anxiousness goes to make a single iota of distinction to the value of crypto.

The excellent news is which you could flip all that inefficient inwards vitality into optimistic outwards construct vitality that will truly impression the way forward for the world.

It all begins with sustaining your psychological health. Here are a number of simple methods to creating that occur, even when the market appears to be like like a foul day in Mordor.

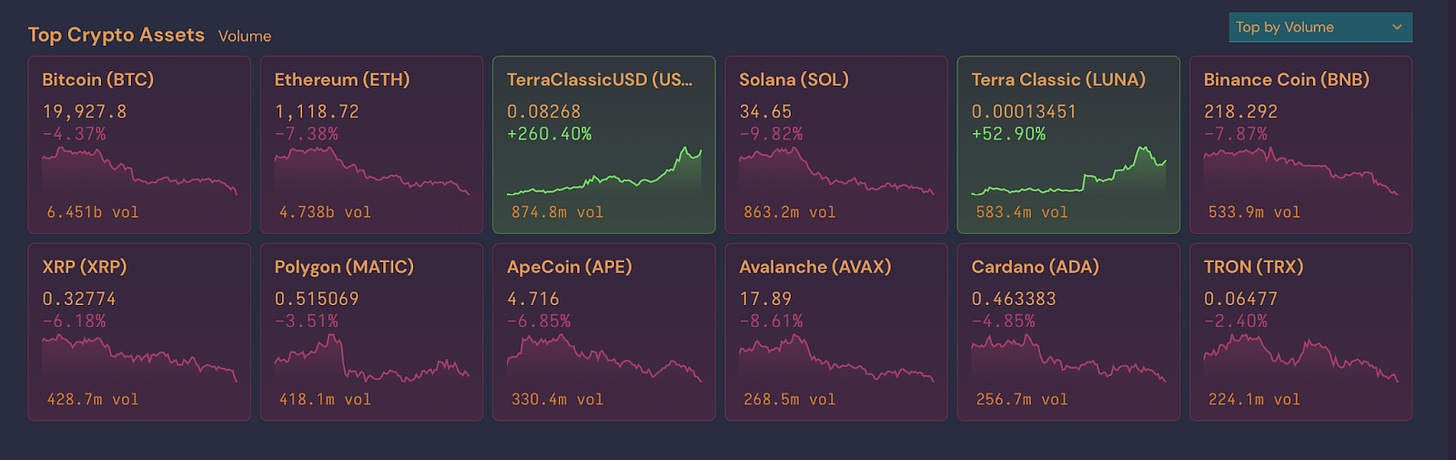

#1: Stop wanting on the charts each 5 minutes.

You gotta be kidding me // Cryptowatch

You gotta be kidding me // Cryptowatch

This is completely at the start a very powerful factor you are able to do to maintain your head screwed on straight over an extended bear market: cease compulsively checking the charts.

Just because it’s simple to get obsessive about checking charts when the market goes parabolic — I’m wealthy, mother! — for a fast hit of dopamine, it’s simple to get obsessed doomchecking your holdings as they slowly (and typically rapidly) dwindle: “I’ve f*cked every little thing up!”

That’s like giving your self a zap of unhealthy information on a frequent and constant foundation over the course of months. Are you a analysis rat in a pavlovian despair research?

No, anon. You deserve greater than that. You’re a human being.

Either flip notifications off, or change them so that you’re solely up to date when large swings happen.

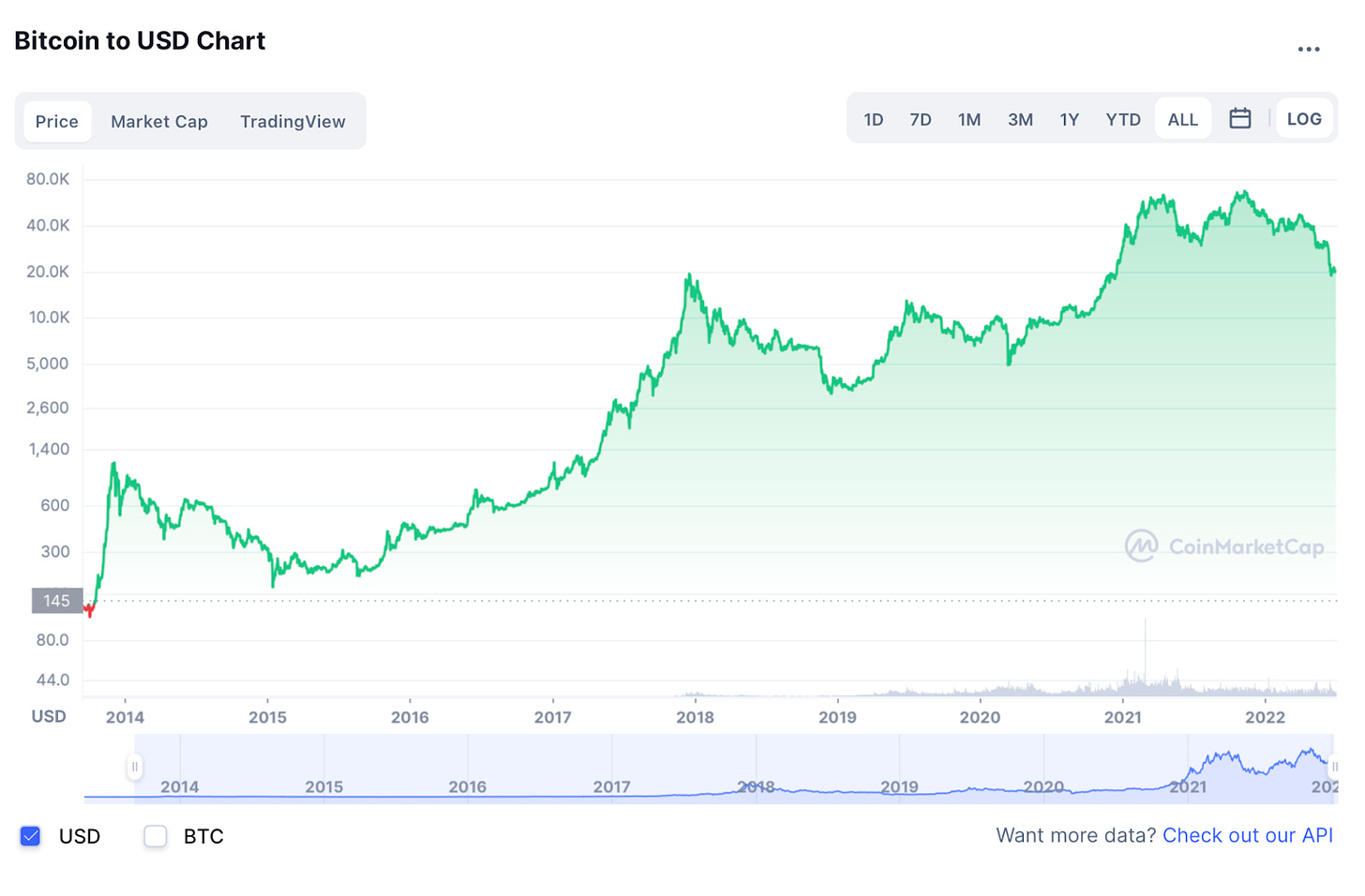

#2: Zoom out.

Look at this.

Now take a look at this.

Now let’s play a sport. Pick a place to begin on any of those charts. Any level: peak, trough, no matter. Note the quantity.

Move ahead three years. Is the quantity up? Yes it’s.

It is up a LOT? Yes it’s.

Yay! You win.

It’s not matter of “if,” however “when.”

#3: Be Loss Aversion Averse.

So there’s this factor, a confirmed psychological idea known as loss aversion, derived from the research of subjective likelihood.

“The response to losses is stronger than the response to corresponding good points”

It principally says that people are inclined to exhibit an irrational financial habits of seeing losses as worse than corresponding good points.

In truth, a research within the Journal of Risk and Uncertainty (sure, that could be a actual factor) discovered that loss aversion implies that shedding cash might be twice as efficient in your psyche than gaining an equal quantity.

This is a few deep monkey mind, instinctive habits that appears to be onerous coded into lots of us. It’s not environment friendly on this trendy world. The fact is that when it’s good, it’s higher than you suppose it’s, and when it’s unhealthy, its by no means as unhealthy as you suppose it’s.

Some of you svengalis will have the ability to establish loss aversion and change it off, others of us can have a harder time disbelieving our personal instincts.

A great way to start out is: Don’t base your complete happiness and self-worth over a quantity on a display.

Or right here’s one other workaround: simply worth your portfolio in ETH.

If you maintain, that quantity can solely ever go up.

#4: Divorce your baggage

There are a number of totally different causes we spend money on crypto.

Sometimes it’s as a result of we consider deeply in an rising tech.

Sometimes it’s as a result of we noticed some degen tweet some hype, acquired sucked right into a pump, and forgot to promote earlier than it was too late.

Here’s a listing of hype tokens from 2017 that you simply’ve in all probability forgotten about: OMG, ICON, MIOTA, TENX, NEM, NXT, DRGN, DASH, WNGS, REQ, AION, XCP, POE, BCC.

This record goes on.

And on.

Lots of these tokens dropped 95% and have been by no means heard from once more. Some of them ended up being straight up scams.

You is likely to be married to your baggage, however your baggage are usually not married to you. Whittle your holdings right down to the tokens you consider in to be sturdy long-term, and chill on the hail marys for a number of months.

#5: Actively struggle burnout.

Burnout is admittedly in regards to the lack of two components: steadiness and reward.

I do know we discuss bear markets as construct markets, however except you’re a developer or deep in crypto, chances are high you’re not seeing lots of that constructing occurring. If your main metric or KPI for crypto is value, then your reward synapses won’t be bolstered for a very long time, and your mind will go unhappy unhealthy.

There are loads of different methods to search out reward in crypto: be taught new issues, be part of a DAO, interact with new Web3 merchandise, be early on a brand new tech, make human connections, catch an airdrop, contribute in your personal means, get a job in crypto, meet Web3 folks within the meatverse.

Let’s discuss steadiness. Holding throughout a bear market is 65% boredom, 25% sheer panic, and 10% futile, broad eyed optimism. Rinsed and repeated over the course of a pair years, that could be a deeply imbalanced existence — significantly if crypto has taken over your life.

If crypto has grow to be the principle factor in your life, it’s in all probability sensible to search out a bit of steadiness from elsewhere: household, mates, hobbies, or, uh, y’know: experiencing life and never a digital facsimile of it.

Literally something will do as long as it’s largely authorized.

It’s summertime. Go exterior. Stroke a hedgehog. They’re lovely! 🦔.

#6: Address your personal macro.

Just because the crypto market is beholden to the bigger macro-economy, your personal psychological health with reference to crypto is beholden to your personal macro psychology.

Let’s say you’re perhaps form of a multitude. Imagine for a second that ETH hit $20k and also you bought all of it. You’d nonetheless in all probability be a multitude, albeit a wealthier one.

For instance: If you’ve got an addictive persona, chances are high you take a look at the chance of buying and selling in a bear market like a canine watching a Slim Jim. Just one fast flip of a scorching small cap, proper?

Bad degen! That’s a mega-fast strategy to bankrupt your self, bear or bull market.

Ultimately, crypto isn’t actually the issue right here. It’s the underlying psychology. You can extrapolate this notion to accommodate any variety of psychological quirks: despair, anxiousness, OCD, anger, and many others.

If your relationship with crypto is a vessel for a deeper concern, you finally have to handle that concern to get anyplace. So tackle your macro, after which re-address your relationship to the crypto market with a transparent(er) head.

#7: Don’t take a look at, lean in.

If you bought into the crypto sport for fast riches, I’ve some unhealthy information for you…You did it mistaken. So let’s speak ‘get wealthy sluggish’ schemes as a substitute.

There shall be many moments the place you’re tempted to surrender on crypto and Web3, promising your self that you simply’ll verify again in when issues are scorching.

The drawback is, by the point folks determine issues are scorching, they’ve missed all of the alternatives for generational wealth. The standout initiatives of the following bull run will launch within the deepest depths of this bear.

So as a substitute of testing, decide to leveling up your information and involvement. Find a strategy to carry your personal abilities to the desk. Reassert your targets. Audit your info sources: Are you positive Bitboy is an effective use of your time? Is your model of Crypto Twitter extra about moonshots and drama than substantive discourse? Mix it up!

Most importantly: Make positive you’re tuned in when the alternatives seem. It received’t require rocket science, only a clear head and a eager eye. With your psychological health accommodated, you’ve got a greater probability at working with each in play.

Conclusion

In prior bear cycles, there was the looming, existential risk that blockchain know-how was vaporware and may very well recede to nothing with completely no discover and we might all be broke eternally.

This time, there may be actually 0% probability that this know-how goes to fizzle away. Everyone is aware of that it really works. it’s nearly scaling and growing, all of which is going on at a fast tempo.

Anon, we dwell in unsure occasions.

Actually, they’re all unsure occasions.

But if every little thing was static, there could be no alternative.

Action steps

Author Bio

Jem Khawaja is Editor of the Bankless Newsletter. He has held editorial positions at Vice, The Guardian, ConsenSys, Solana, and Gemini. His 5 nice loves are: Prog-rock, techno, Liverpool FC, the Pakistan Cricket workforce, and Ethereum.

Subscribe to Bankless. $22 per mo. Includes archive entry, Inner Circle & Badge.

🙏Thanks to our sponsor

Polygon Studios is on a mission to assist construct digital tradition, play-to-earn gaming, NFTs, and the Metaverse ecosystem on Polygon. Some of the important thing initiatives supported by Polygon Studios embrace The Sandbox, Skyweaver, Big Time, Crypto Unicorns, and Decentraland—amongst others. Polygon Studios additionally helps fundraising & onboarding. Check it out right here.

Stay up to date on the most recent wonderful gaming, NFT, and metaverse initiatives:

👉 Join the Polygon Studios Discord

👉 Follow Polygon Studios on Twitter

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not monetary or tax recommendation. This e-newsletter is strictly academic and isn’t funding recommendation or a solicitation to purchase or promote any property or to make any monetary choices. This e-newsletter shouldn’t be tax recommendation. Talk to your accountant. Do your personal analysis.

Disclosure. From time-to-time I’ll add hyperlinks on this e-newsletter to merchandise I exploit. I’ll obtain fee in case you make a purchase order via one among these hyperlinks. Additionally, the Bankless writers maintain crypto property. See our funding disclosures right here.